Comprehending the Basics of Limited Obligation Business (LLCs).

When starting a business, one of the vital decisions entrepreneurs encounter is selecting the right structure. Among the various organization structures, the Minimal Liability Company (LLC) attracts attention because of its adaptability, protection, and effectiveness. An LLC is an organization structure allowed by state law that can be made use of to run a service or hold assets such as genuine estate, vehicles, and boats. The key charm of an LLC is that it combines the minimal responsibility security of a company with the tax efficiencies and functional flexibility of a partnership. The proprietors of an LLC are referred to as members, and depending upon the jurisdiction, an LLC can have one member (a single-member LLC) or numerous participants (a multi-member LLC).

Establishing an LLC involves several actions, consisting of choosing an unique name that abides by state requirements, submitting the needed documentation with a state firm (generally the Secretary of State), and paying a filing cost that differs by state. The majority of states call for LLCs to file Articles of Company, which describe the fundamental details concerning the LLC, such as its name, objective, workplace address, and information concerning its participants and signed up agent. After developing an LLC, it's essential to compose an Operating Contract. Although not always legitimately needed, this inner record controls the LLC's procedures and lays out the legal rights and obligations of the members. It functions as an important device for preventing and solving disputes amongst participants by setting clear expectations concerning administration structure, profit sharing, and treatments for managing the departure or enhancement of members.

Comprehending the Framework and Advantages of LLCs

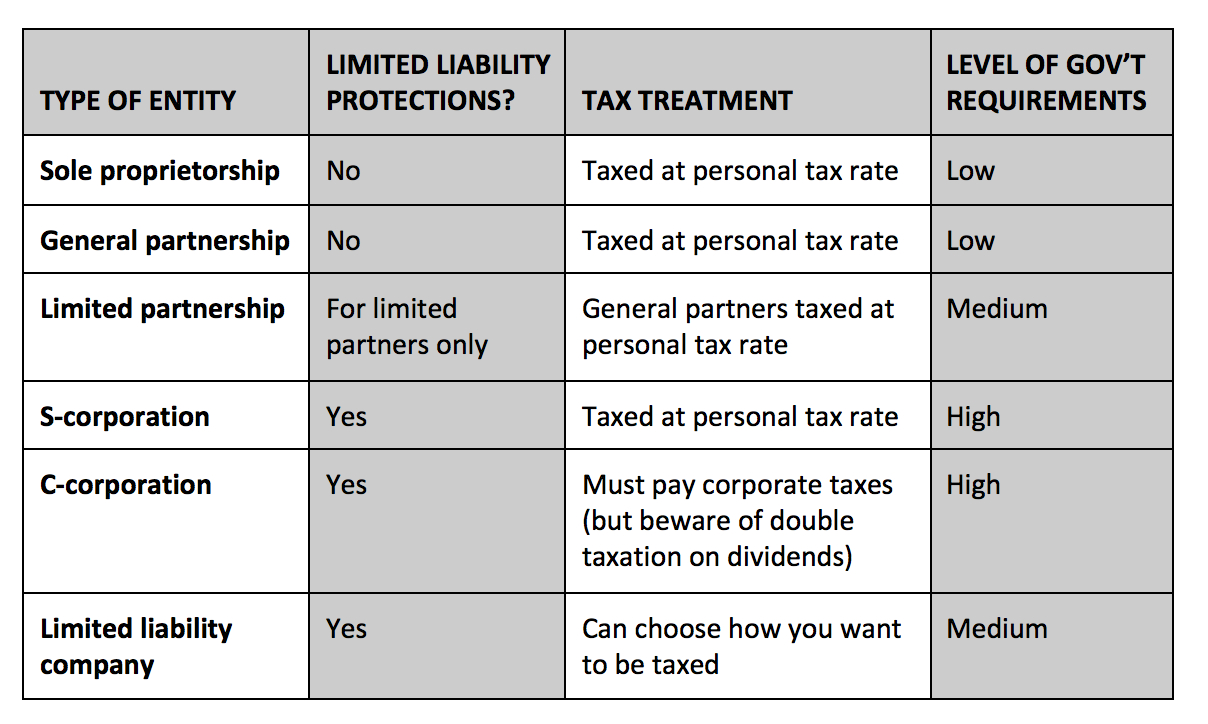

Minimal Responsibility Firms (LLCs) are a prominent form of company structure that combine the versatility of a collaboration with the responsibility defense of a company. This hybrid framework is specifically enticing because it provides company owner, commonly described as members, with a shield against personal liability, meaning personal properties are generally protected in the case of service debts or lawsuits. Additionally, LLCs are known for their tax effectiveness. Unlike this contact form , which deal with double taxes— initially on corporate revenues and once more on returns— LLCs take pleasure in pass-through taxation, where profits and losses are straight reported on the private participants' income tax return, thus avoiding corporate taxes. This can cause significant tax savings relying on the private tax obligation scenarios of the members.

An additional benefit of LLCs is their functional flexibility. There are less legal needs for exactly how LLCs need to be taken care of compared to firms. Members can select to handle business straight, or they can appoint supervisors to handle everyday operations, which is beneficial for participants that choose not to be entailed in the everyday operating of the business. This versatility prolongs to the allotment of revenues and losses, which can be dispersed in a different way from possession percentages if concurred upon in the LLC operating arrangement. This is especially valuable in circumstances where members add various amounts of resources, competence, or time.

Additionally, establishing an LLC can improve a company's trustworthiness with prospective clients, staff members, and partners by including a degree of professionalism and trust to its operations. The registration of an LLC likewise assists protect the company name at the state degree, which can be an essential element of brand name identity. Moreover, due to the fact that the needs and fees for developing an LLC differ from state to state, entrepreneur have the adaptability to choose a state whose laws best fit their demands. For example, some states offer extra positive conditions for personal privacy, while others could have reduced charges or offer more valuable economic conditions for certain sorts of organizations.

Finally, the advantages of developing an LLC are manifold, including boosted legal protections, tax performances, operational flexibilities, and enhanced business trustworthiness. These elements incorporated make LLCs an appealing choice for several business owners aiming to balance the needs of service operations with the protections required to safeguard their personal possessions and future organization growth.

Understanding the Structure and Advantages of an LLC

Restricted Obligation Business (LLCs) use a effective and functional framework for company owner, combining the obligation protection of a corporation with the adaptability and tax obligation efficiencies of a partnership. An LLC's specifying particular is that it shields its owners, referred to as members, from personal obligation for the debts and obligations of business, similar to a company. This implies personal properties such as a participant's home, cars and truck, or financial savings stay secured in the occasion that the LLC deals with bankruptcy or claims. Members can consist of individuals, corporations, other LLCs, and international entities, and there is no maximum number of participants. One of the primary benefits of an LLC is the flexibility in administration. Unlike companies, LLCs are not needed to have a board of directors or hold regular board meetings, that makes them an especially attractive choice for little to medium-sized enterprises. about us company profile is an additional location where LLCs display significant versatility. They can select to be exhausted as a single proprietorship, collaboration, S corporation, or C corporation, allowing participants to pick one of the most beneficial tax obligation therapy for their specific circumstances. This option directly affects exactly how revenues are dispersed and exhausted— in the case of a sole proprietorship or collaboration, revenues are strained only once as personal income, which avoids the double taxes faced by C corporations. In addition, running contracts— a vital file for every single LLC— enable members to specify their monetary and working connections in adaptable, tailored means that finest suit their company needs, supplying clarity and anticipation for numerous company scenarios.

Comprehending the Structure and Benefits of LLCs

Restricted Liability Companies (LLCs) are a popular option for organizations of all sizes due to their flexibility and defense advantages. An LLC distinctively integrates the pass-through taxation of a collaboration or sole proprietorship with the minimal responsibility of a firm. This framework suggests that LLC proprietors, frequently referred to as members, are not personally liable for the firm's liabilities and debts. This security is a significant advantage, as it can shield individual assets such as homes or financial savings in case the business deals with suits or debts. An additional attractive aspect of an LLC is its flexibility in monitoring. Unlike companies, which are required to have a board of directors and business officers, an LLC can be taken care of straight by its participants or by selected supervisors. This can be especially helpful for smaller business that choose a more streamlined and much less official administration framework. LLCs provide substantial versatility in terms of taxation. By default, an LLC is dealt with as a pass-through entity for tax obligation objectives, implying that the service itself does not pay taxes on its revenues. Rather, profits and losses are travelled through to the participants, that report them on their personal income tax return. However, an LLC can also select to be exhausted as a corporation if this proves even more beneficial. This ability to pick the most helpful tax structure includes to the LLC's charm. Developing an LLC can be a relatively uncomplicated procedure, with fewer formalities and demands compared to corporations. The needed steps normally consist of choosing an one-of-a-kind name, submitting the Articles of Organization with the ideal state company, and paying any kind of requisite fees. Some states also need the development of an Operating Arrangement, which lays out the monitoring framework and operating procedures of the LLC. Generally, the convenience of development and operational simpleness, incorporated with obligation defense and taxes alternatives, make LLCs an extremely appealing alternative for many entrepreneurs and services.

Strategic Conveniences and Considerations for Creating an LLC

The choice to form a Restricted Liability Firm (LLC) brings with it many critical benefits and considerations that are important for service owners to comprehend. Primarily, an LLC framework provides individual obligation protection, which separates and secures individual possessions from business financial debts and responsibilities. This implies that in the case of lawsuits or company financial debts, the personal possessions of the proprietors— such as individual bank accounts, homes, and other financial investments— are secured from financial institutions. Another significant benefit of an LLC is the tax obligation flexibility it provides. Unlike corporations, LLCs are exempt to corporate tax obligations. Rather, the company's income is gone through to individual owners and reported on their personal income tax return, which can cause considerable tax cost savings and simpler tax obligation preparation. Additionally, LLCs delight in significant adaptability in administration and organization. They are not required to abide by the strict functional processes of companies, such as holding yearly meetings or preserving in-depth company minutes, which can minimize governmental concerns and boost functional flexibility. Furthermore, the integrity that an LLC brings can improve an organization's partnership with potential investors and companions. It indicates an official dedication to the venture which can be helpful in elevating capital. Nonetheless, forming an LLC is not without its costs and challenges. The process includes declaring costs, which differ by state, and potentially greater ongoing fees compared to single proprietorships or collaborations. While the versatility in tax obligation standing is useful, it can likewise make complex financial planning and the procedure of understanding the best tax obligation strategy can be complex and could need professional recommendations. Finally, as each state has its own regulations and guidelines regarding LLCs, understanding and browsing these lawful landscapes can be complicated and often calls for lawful help. Regardless of find more info , for numerous entrepreneurs, the benefits of creating an LLC— such as responsibility protection, tax obligation benefits, and enhanced credibility— exceed the downsides, making it a compelling choice for those aiming to start a new service or define an existing one.